$150,000 still buys you a home in these California cities Would you buy here? Los Angeles Times

Table Of Content

Closing costs also help keep lenders in business and allow them to offer mortgages to other consumers. Mortgage lenders and brokers also have to follow numerous regulatory requirements that can increase their costs (and yours) but may also help protect you as a borrower. Title search and title insurance fees can easily add another $1,000 or more. Apply online for expert recommendations with real interest rates and payments.

Average Closing Costs By State

There are a number of ways to reduce your upfront closing fees. When someone buys real estate, a new deed showing their ownership must be filed with the local county recorder. This document shows the new ownership of the property, and counties typically charge a nominal fee for filing the new deed. Some lenders offer borrowers the option of lowering their interest rate in exchange for prepaying a portion of the interest due over the term of their loan. For every 1% of interest that borrowers prepay, they can usually lower the interest rate for the term of their loan by about 0.25%.

Prepaid Daily Interest Charges

Before taking on a mortgage and buying a house, most people want to know everything they can about how purchasing a home will impact their finances. Your lender might require you to pay up to a year’s worth of property taxes at closing. You can estimate your property taxes using public records and your appraisal value.

California First-Time Home Buyer 2024 Program & Grants - The Mortgage Reports

California First-Time Home Buyer 2024 Program & Grants.

Posted: Fri, 19 Apr 2024 07:00:00 GMT [source]

Closing Costs Calculator

You will likely need to pay $15 – $25 for a flood certification. This money goes to the Federal Emergency Management Agency (FEMA), which uses the data to plan for emergencies and target high-risk zones. This closing cost only applies if you’re buying a house in a flood zone. It’s a conventional loan, so the seller can only contribute a maximum of 3% ($6,000) toward your closing costs if you make a down payment of less than 10%.

What’s included in closing costs?

There are some closing costs that sellers almost always pay themselves. These include real estate agent commissions, prorated real estate taxes and transfer taxes. In certain cases, sellers may also pay the cost of a home warranty (if they’re providing one) and fees for any associations that their property belongs to. These costs come about through the process of creating your loan. Closing costs cover the fees for services like your home appraisal and searches on your home’s title.

Can you negotiate real estate agent commission fees?

I had an issue with my other mortgage company that I had been working with and upon contacting RK Mortgage. Joelle was able to jump right in resolve the situation and help me close on my home. Would highly recommend them for anyone on the market looking to purchase a new home.

I highly recommend RK Mortgage Group for refinancing issues. RK Mortgage Group was considerate of my family's needs and provided options. They educated my wife and myself on the process and helped us make an informed decision . Ms. Meme excellent, very professional, patience of an angel. She kept us updated on everything that was happening with our loan.

This calculator allows you to estimate your closing costs using your state and county. For more precise results, you can adjust existing or add new expenses to the closing costs in the results section. If the closing costs are too steep and the sellers won’t chip in as much as buyers would like, the buyers can request that real estate closing costs be rolled into the mortgage. If you’re buying a home, you’re likely off the hook for paying the real estate agent commission because the home seller is almost always responsible.

But if you don’t plan to keep the loan for its full term, your monthly savings from refinancing might be more important than the long-term cost. Note that closing costs are separate from your down payment, though some lenders may combine them into a single number on your closing documents. Closing costs are a collection of fees required to set up and close a new mortgage. They can range from 2-5% of the mortgage amount for both home purchase and refinance loans. Loan origination fees are a percentage of the loan value that borrowers pay in order to secure their loan. These points may cover the loan origination fee (usually a flat amount) as well as an application fee that some lenders charge.

A seller and a buyer pay for different expenses, so they pay different amounts. On average, a buyer pays 3% to 6% of the home price towards closing costs while a seller may pay up to 12% of the home price towards closing costs. Depending on the market, some items in the closing costs may be negotiated between the buyer and the seller depending on who has more negotiating power. In addition to that, depending on where the deal takes place, a buyer or a seller may be required to pay for certain items that they are not required to pay for elsewhere. Private mortgage insurance is required if your down payment is less than 20%.

The cost of a loan to the borrower, expressed as a percentage of the loan amount and paid over a specific period of time. How much closing costs are for the seller can vary depending on the buyer's loan program, but they typically range from 2%–5% of the purchase price. The buyer's down payment must also be paid at closing, but it is listed separately from the closing costs.

Real estate attorney charges often depend on state and local rates. Some lenders charge an application fee to process your loan request. The application fee may be a separate fee or used as a deposit that will be applied to other closing costs. Not every buyer will pay the same amount in closing costs. Some costs are lender requirements, some are government requirements and others may depend on the situation. How much you’ll need to pay for will depend on where you live, your specific lender and the type of loan you take out.

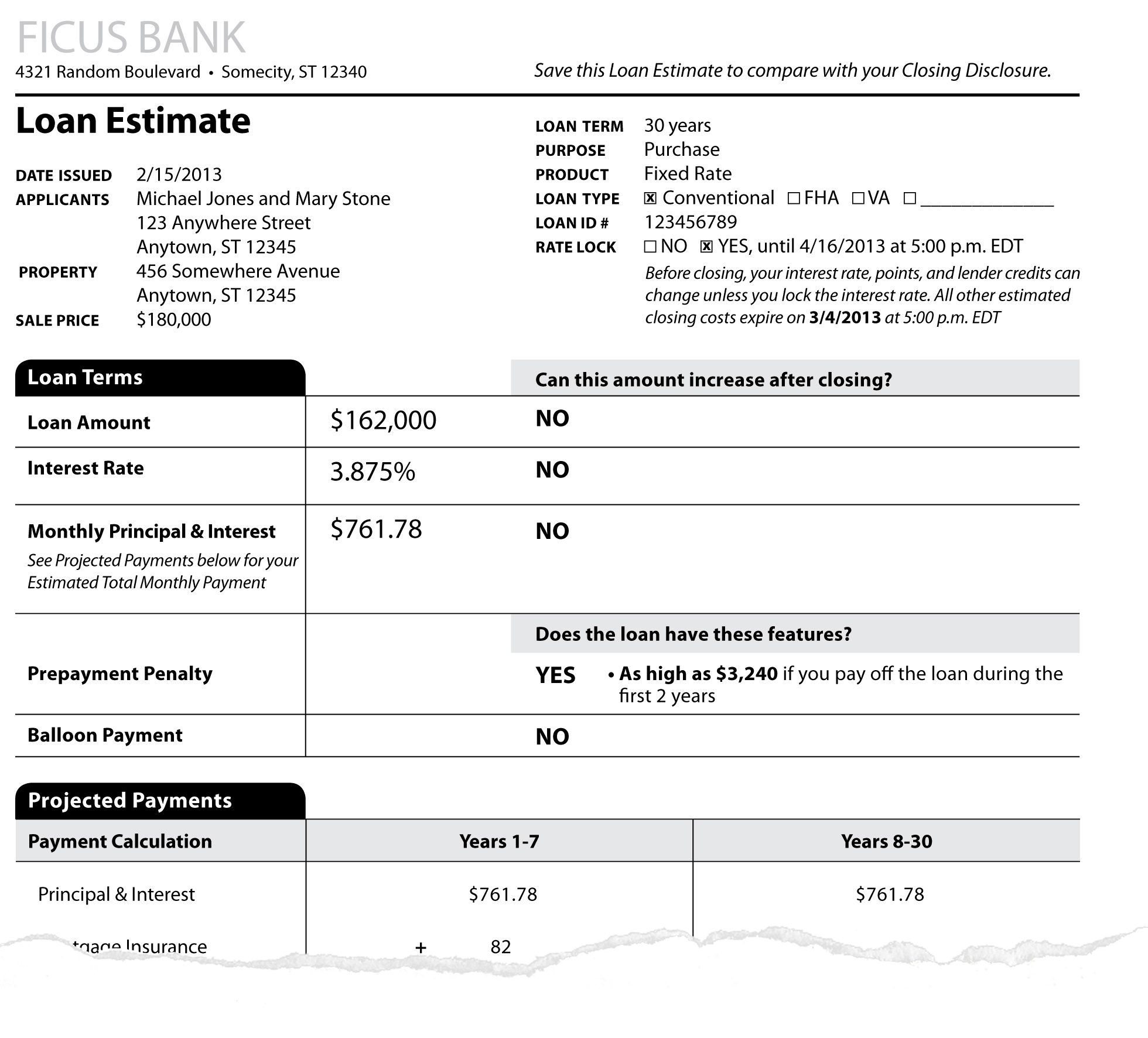

This consent applies even if you are on a corporate, state or national Do Not Call list. Money collected from the borrower by the lender (typically as part of the monthly mortgage payment) in order to pay property taxes and homeowners insurance premiums. When you apply for the mortgage, your lender is required to provide you the Loan Estimate document which will include an outline of the closing costs. Regardless of whether you’re buying or selling, navigating the complexities of a real estate transaction can be far easier with a professional at your side. When looking for an agent, a good place to start is asking friends and relatives who have had a positive experience with their own Realtor.

Since all lenders must follow the same rules to ensure the accuracy of the APR, borrowers can use it as a good basis for comparing loan costs. Closing costs can be divided into four main cost segments with each having its own subset of fees. Some of the fees are fixed, such that their cost does not change from situation to situation.

Comments

Post a Comment